Bank of Valletta (BOV) Case Study – Document Management Solution to improve security and efficiency

Major bank in Malta uses Therefore™ and Scan2x to create a document management solution which improves data security and efficiency throughout the organisation.

Bank of Valletta is Malta’s largest bank in terms of market share, with around 2,000 employees. It offers a full range of financial services, including private banking, investment banking, fund management, bank insurance, as well as brokerage services. It has a network of branches, a corporate centre, multiple business centres and a wealth management arm. It is one of Malta’s largest employers, committed to offer excellent customer service, efficient operations and a high level of security.

Bank of Valletta has embarked upon a bank-wide project to integrate document and information management technology in every aspect of business to improve on their customer service, internal audit and compliance readiness, data protection and security.

Major bank in Malta uses Therefore™ and Scan2x to create a document management solution which improves data security and efficiency throughout the organisation.

Bank of Valletta needed a solution to ensure better disaster recovery capabilities within their Collateral Management Unit (CMU).This requirement was related to very valuable collateral documents that the bank holds for each customer loan.

All this documentation was held in an armoured document store, and in this room they have an automated filing system to process all the paper. Should these documents be misplaced, damaged or otherwise lost, the bank would have a major disaster to deal with. A lesser concern was that all this documentation was stored in a single place, while the bank has sixty branches across the country. Accessing these documents, mostly when dealing with clients was complicated and potentially insecure. While the banking system, based on Oracle software, is very modern and up-to-date, this department had no digital asset management at all.

For this first project, the bank issued a tender and among other competitors, Canon Certified Partner Avantech proposed a solution consisting of Canon’s document scanners and Therefore™ document management system. Avantech successfully convinced the management of Bank of Valletta that Therefore™ was the best solution by performing a live demonstration of its capabilities. Because security is a major issue, it was very important that Therefore™ is completely integrated with Active Directory and can ensure document security.

The system allows access only to people that have the necessary security clearance and also offers advanced disaster recovery management and business continuity features. Combined with Therefore™’s flexible integration abilities and powerful management of client interactions with documents, these were key advantages that tipped the scales in favour of Avantech’s proposition.

“The Collateral Management Unit in Bank of Valletta handles all the legal and contractual documentation of the bank. The management wanted to ensure that this documentation was completely secure, and that is why we began the deployment in this department,” said Nick Camilleri, Managing Director, Avantech. This is considered as the smallest Avantech project in Bank of Valletta in terms of volume, but a big success in terms of business continuity and disaster recovery. Avantech implemented six Canon imageFORMULA DR-G1100 document scanners and the Business Edition of Therefore™ with twenty-five concurrent user licenses. The deployment was concluded in March 2011.

At first, the bank’s only requirement was to provide security for these paper documents with a scanning solution and a document management system this issue would have been resolved, but Avantech proposed that they better utilise their investment in time, software and hardware. Linking the document management system to their banking system would allow employees in branch offices to have instant access to collateral documents. The document system could retrieve more data about the customer in the banking system and store it with each scanned document.

“At the demonstration we saw that this is the answer to a lot of our requirements. There was also some added value, like the integration with external databases and the possibility of integration with other systems,” commented Marco Scicluna, Executive Head of IT Systems, Bank of Valletta.

“This was the starting point for developing software and webbased services to help them integrate their back-end banking system with the document management system. Therefore™’s customisation options are vast and allowed us to demonstrate multiple different options. We were able to show them a concept for document storage, indexing and retrieval, integrated with their banking system and interfacing with their external databases,” added Camilleri.

“The installation was very smooth. Users began using the system within a couple of days after installation. The fact that we have a solution that comes from Canon and Therefore™ and is designed by one company, made things easier for us, because we have one point of contact. The project was such a success that we have decided to implement it across the entire bank,” commented Scicluna.

For its first project in Bank of Valleta, Avantech implemented six Canon imageFORMULA DR-G1100 document scanners and the Business Edition of Therefore™ with twenty-five concurrent user licenses.

“Therefore™ gave us the advantage of introducing an electronic filing system that proved extremely useful in terms of reducing storage space and improving our efficiency by allowing our users to take full advantage of access to the system from their own computers. And this also helped the bank in its aim of becoming an environmentally friendly bank by reducing the waste of paper.”

Edward Grech – Head of Home Loans, Bank of Valletta

Bank of Valletta is Malta’s largest bank in terms of market share, with around 2,000 employees. It offers a full range of financial services, including private banking, investment banking, fund management, bank insurance, as well as brokerage services. It has a network of branches, a corporate centre, multiple business centres and a wealth management arm. It is one of Malta’s largest employers, committed to offer excellent customer service, efficient operations and a high level of security.

Bank of Valletta has embarked upon a bank-wide project to integrate document and information management technology in every aspect of business to improve on their customer service, internal audit and compliance readiness, data protection and security.

Bank of Valletta needed a solution to ensure better disaster recovery capabilities within their Collateral Management Unit (CMU).This requirement was related to very valuable collateral documents that the bank holds for each customer loan.

All this documentation was held in an armored document store, and in this room they have an automated filing system to process all the paper. Should these documents be misplaced, damaged or otherwise lost, the bank would have a major disaster to deal with. A lesser concern was that all this documentation was stored in a single place, while the bank has sixty branches across the country. Accessing these documents, mostly when dealing with clients was complicated and potentially insecure. While the banking system, based on Oracle software, is very modern and up-to-date, this department had no digital asset management at all.

For this first project, the bank issued a tender and among other competitors, Canon Certified Partner Avantech proposed a solution consisting of Canon’s document scanners and Therefore™ document management system. Avantech successfully convinced the management of Bank of Valletta that Therefore™ was the best solution by performing a live demonstration of its capabilities. Because security is a major issue, it was very important that Therefore™ is completely integrated with Active Directory and can ensure document security.

The system allows access only to people that have the necessary security clearance and also offers advanced disaster recovery management and business continuity features. Combined with Therefore™’s flexible integration abilities and powerful management of client interactions with documents, these were key advantages that tipped the scales in favour of Avantech’s proposition.

“The Collateral Management Unit in Bank of Valletta handles all the legal and contractual documentation of the bank. The management wanted to ensure that this documentation was completely secure, and that is why we began the deployment in this department,” said Nick Camilleri, Managing Director, Avantech. This is considered as the smallest Avantech project in Bank of Valletta in terms of volume, but a big success in terms of business continuity and disaster recovery. Avantech implemented six Canon imageFORMULA DR-G1100 document scanners and the Business Edition of Therefore™ with twenty-five concurrent user licenses. The deployment was concluded in March 2011.

At first, the bank’s only requirement was to provide security for these paper documents with a scanning solution and a document management system this issue would have been resolved, but Avantech proposed that they better utilise their investment in time, software and hardware. Linking the document management system to their banking system would allow employees in branch offices to have instant access to collateral documents. The document system could retrieve more data about the customer in the banking system and store it with each scanned document.

“At the demonstration we saw that this is the answer to a lot of our requirements. There was also some added value, like the integration with external databases and the possibility of integration with other systems,” commented Marco Scicluna, Executive Head of IT Systems, Bank of Valletta.

“This was the starting point for developing software and webbased services to help them integrate their back-end banking system with the document management system. Therefore™’s customisation options are vast and allowed us to demonstrate multiple different options. We were able to show them a concept for document storage, indexing and retrieval, integrated with their banking system and interfacing with their external databases,” added Camilleri.

“The installation was very smooth. Users began using the system within a couple of days after installation. The fact that we have a solution that comes from Canon and Therefore™ and is designed by one company, made things easier for us, because we have one point of contact. The project was such a success that we have decided to implement it across the entire bank,” commented Scicluna.

For its first project in Bank of Valleta, Avantech implemented six Canon imageFORMULA DR-G1100 document scanners and the Business Edition of Therefore™ with twenty-five concurrent user licenses.

“Therefore™ gave us the advantage of introducing an electronic filing system that proved extremely useful in terms of reducing storage space and improving our efficiency by allowing our users to take full advantage of access to the system from their own computers. And this also helped the bank in its aim of becoming an environmentally friendly bank by reducing the waste of paper.”

Edward Grech – Head of Home Loans, Bank of Valletta

Having a substantial number of branches and employees, Bank of Valletta needed to find a way to standardise their way of onboarding documents of all types.

Bank of Valletta needed to implement a solution that would minimise human error, simplify the scanning and archiving process and increase the efficiency of its’ employees and the services to its clients.

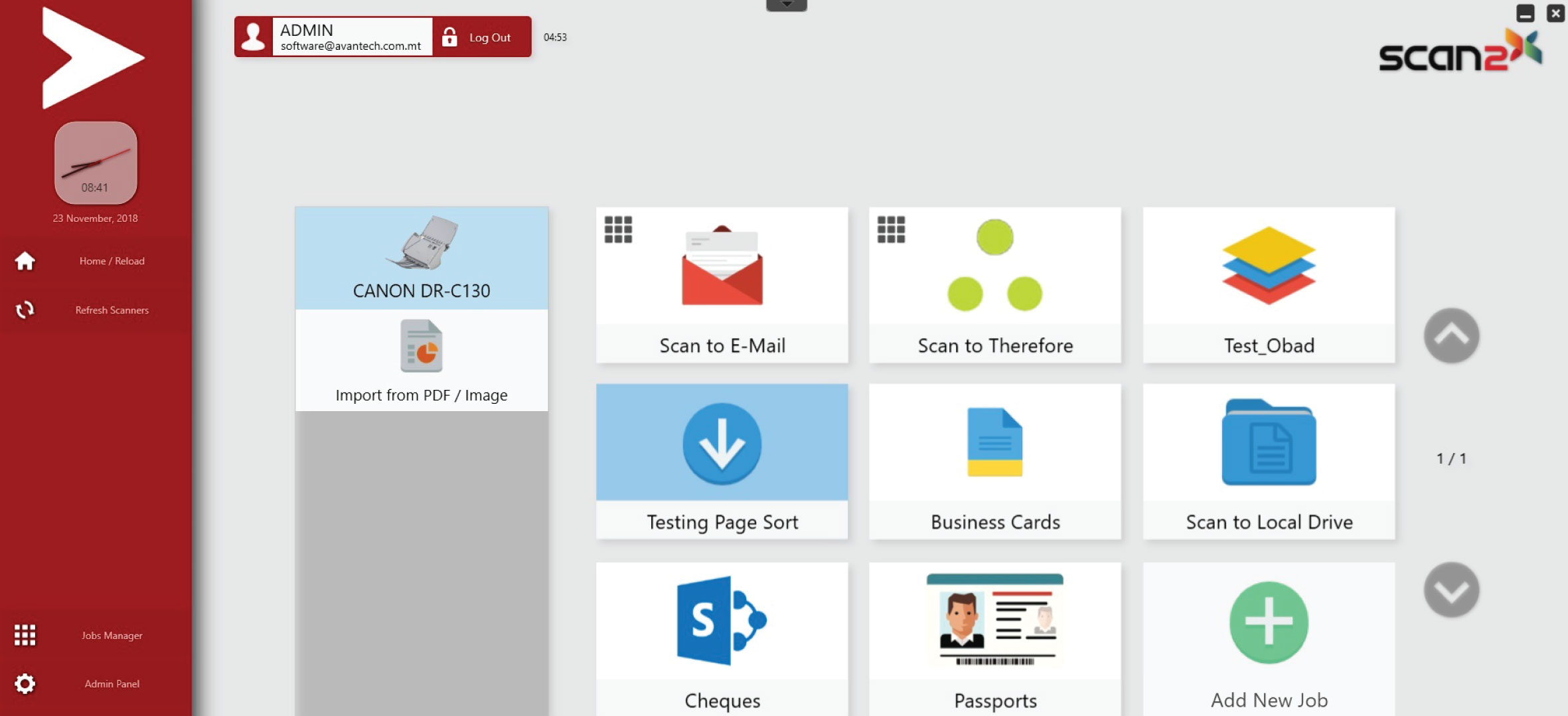

Avantech proposed that Bank of Valletta use Scan2x, the intelligent document capture system, as it’s document capture solution. Scan2x helped Bank of Valletta by allowing the bank to create standardised scanning profiles centrally and automatically push them to all of their branches. This simple process of creating and maintaining customised scanning profiles makes the process more efficient with full traceability and accountability.

With Scan2x installed at all of the bank’s offices, the employees simply have to walk up to the scanner, choose the job profile, scan and walk away. All the archiving, categorisation and even workflow are done automatically by Scan2x. This procedure improved efficiency, restricted human error and made scanning and archiving a hasslefree one-touch procedure.

“By implementing SCAN2x and Therefore™, we have been able to improve data security, efficiency, compliance and disaster recovery.”

Marco Scicluna – Executive Head of IT Systems, Bank of Valletta

Having a substantial number of branches and employees, Bank of Valletta needed to find a way to standardise their way of onboarding documents of all types. The system had to be able to deal with bank forms, identity documents and pre-printed stationery and it had to be centrally managed.

Bank of Valletta needed to implement a solution that would minimise human error, simplify the scanning and archiving process and increase the efficiency of its’ employees and the services to its clients.

Avantech proposed that Bank of Valletta use Scan2x, the intelligent document capture system, as it’s document capture solution. Scan2x helped Bank of Valletta by allowing the bank to create standardised scanning profiles centrally and automatically push them to all of their branches.This simple process of creating and maintaining customised scanning profiles makes the process more efficient with full traceability and accountability.

With Scan2x installed at all of the bank’s offices, the employees simply have to walk up to the scanner, choose the job profile, scan and walk away. All the archiving, categorisation and even workflow are done automatically by Scan2x. This procedure improved efficiency, restricted human error and made scanning and archiving a hasslefree one-touch procedure.

“By implementing SCAN2x and Therefore™, we have been able to improve data security, efficiency, compliance and disaster recovery.”

Marco Scicluna – Executive Head of IT Systems, Bank of Valletta

With Avantech’s Canon solution Bank of Valletta achieved several major benefits: efficiency, automation and elimination of human errors; business continuity; and disaster recovery.This is all related to a significant reduction of costs and has had a direct impact on their business, with clients being served more quickly and more efficiently without delays. Branches have also freed up storage space, which enabled them to dedicate more space to their clients.

In recent years the Therefore installation has doubled in size with many more business processes being integrated. The integration of Scan2x with the Therefore system has allowed the Bank to provide its users with instant feedback together with secure audit trails of when documents were captured.

“In addition to the standard disaster recovery and archiving that the bank originally achieved, they have also managed to share all their documents across the entire bank wide area network. They have managed to use full text indexing to their full advantage, and they’ve also managed to ensure that all their documents are available to those with the necessary permissions via the core banking system,” said Camilleri.

Marco Scicluna, Executive Head of IT Systems, Bank of Valletta: “Avantech started our digitisation journey with a small but important project with a relatively small number of very valuable documents. This successfully created a quick win with users and management and paved the way for future internal projects.

Our Therefore DMS has now expanded its scope to span the entire Bank’s operations – front office, back office, admin, compliance, internal audit etc. We have consequently worked with Avantech to create multiple fail-safe procedures to ensure uptime, reflecting the importance that the Avantech solutions now play in the daily execution of the Bank’s businesses.”

Therefore and Scan2x are now deployed in all of Bank of Valletta branches and offices across the country. The bank’s processes are now highly streamlined due to the integration of their backoffice systems with Avantech’s solution and so Bank of Valletta has continued to invest in Therefore and Scan2x licenses and Canon hardware.

With Avantech’s Canon solution Bank of Valletta achieved several major benefits: efficiency, automation and elimination of human errors; business continuity; and disaster recovery. This is all related to a significant reduction of costs and has had a direct impact on their business, with clients being served more quickly and more efficiently without delays. Branches have also freed up storage space, which enabled them to dedicate more space to their clients.

In recent years the Therefore installation has doubled in size with many more business processes being integrated. The integration of Scan2x with the Therefore system has allowed the Bank to provide its users with instant feedback together with secure audit trails of when documents were captured.

“In addition to the standard disaster recovery and archiving that the bank originally achieved, they have also managed to share all their documents across the entire bank wide area network. They have managed to use full text indexing to their full advantage, and they’ve also managed to ensure that all their documents are available to those with the necessary permissions via the core banking system,” said Camilleri.

Marco Scicluna, Executive Head of IT Systems, Bank of Valletta: “Avantech started our digitisation journey with a small but important project with a relatively small number of very valuable documents. This successfully created a quick win with users and management and paved the way for future internal projects.

Our Therefore DMS has now expanded its scope to span the entire Bank’s operations – front office, back office, admin, compliance, internal audit etc. We have consequently worked with Avantech to create multiple fail-safe procedures to ensure uptime, reflecting the importance that the Avantech solutions now play in the daily execution of the Bank’s businesses.”

Therefore and Scan2x are now deployed in all of Bank of Valletta branches and offices across the country. The bank’s processes are now highly streamlined due to the integration of their backoffice systems with Avantech’s solution and so Bank of Valletta has continued to invest in Therefore and Scan2x licenses and Canon hardware.

Interested to know more on how we can help you automate your business workflow and in turn your profits?